uber eats tax calculator australia

Factors like heavy traffic or bad weather that extend the distance or duration of your ride can affect the amount youre. As a self employed person you pay both halves.

How Much Is The Salary Of A Fisherman In Australia Quora

Driver Net GST Liability c 659.

. From processing thousands of Uber BASs weve found that on average your Uber GST bill will be roughly 5-7 of your Net Uber income ie. Your average number of rides per hour. Once you have received your ABN you can register for GST via the ATO.

Fees paid were 8871. Order Australian Food delivery online from shops near you with Uber Eats. The food industry has become very lucrative in Australia.

The amount you receive in your bank account from Uber. Just as with all other income-generating activities if you are a food delivery service provider there are tax. Add a slicer J Pr o tect sheets and ranges.

A common question for Uber and Uber Eats drivers is whether car loan repayments interest or car hire costs are therefore tax-deductible. The average number of hours you drive per week. So you pay 153 of this so called self employment tax.

B As the Total Fare includes GST we divide by 11 to calculate the GST amount. WHY ARE PRICES HIGHER THAN NORMAL. The 124 percent of this tax is for Social Security and the rest 29 percent is for Medicare.

The self-employment tax is very easy to calculate. According to the ATO any Australian resident must declare in your tax return all income you. This calculator will help you work out what money youll owe HMRC in taxes from driving for Uber.

The city and state where you drive for work. Unlike Uber drivers who have different GST obligations to regular individuals food delivery drivers including UberEATS follow regular legislation and are required to register for GST once your turnover within a given 12 month period is more than 75000. S ort sheet.

The first method is cents per kilometres travelled with the current rate being 68 cents per kilometre. So r t range. Get contactless delivery for restaurant takeaway groceries and more.

Its very tough to write off something like a full car payment or lease though. What is an Uber tax calculator. Uber contractors can select between two different methods for claiming car expenses depending on what suits you best.

It automatically calculates your profit or loss for you to include in your annual tax return along with the GST to be included in your quarterly BAS Business Activity Statement. If you are leasing your car to drive for Uber you can deduct the relevant portion of the lease costs proportional. All you need is the following information.

Filter vie w s. If a trip is eligible for an active promotion on your account the trip price will reflect the discount. You may also be able to claim your Uber related.

However like any other occupation standard GST rules apply and if you earn over 75000 per year from your food delivery activities youre required to register for GST. From processing thousands of Uber BASs weve found that on average your Uber GST bill will be roughly 5-7 of your Net Uber income ie. Advance UBER TAXIFY OLA GST and Tax Calculator.

We expect all of our partners to meet their tax obligations like everyone else including declaring Uber earnings in your individual tax return. C lear formatting Ctrl. If you want to get extra fancy you can use advanced filters which will allow you to input.

Create a f ilter. Whether youre in between jobs or needing to earn some extra cash in your spare time working as a food delivery partner is an exciting venture in the world of sole trading. Find the best restaurants that deliver.

Visit the page below to get a price estimate for a trip anywhere Uber is available. If you work as an Uber driver youll have to pay tax on the money you make from driving if you earn over 1000 in a tax year. From what Uber reported to the Australian Tax Department you actually owe 303644 x 325 98684 so yes the Australian tax department is now going to chase you for that money.

Track your car expenses and mileage. To read Instructions on how to use the calculator click here. You simply take out 153 percent of your income and pay it towards this tax.

Regardless of how much you earn as a food delivery driver you still need to report income and expenses in your tax return. Using our Uber driver tax calculator is easy. Video by Bobby-B Music by Beastie Boys with The New StyleJust a basic tutorial explaining how I did my taxes and showing that its actually quite simple to.

This has led to the increase of food delivery companies like Deliveroo Menulog and UberEats. Lodge BAS in Minutes Only 49. With so many people looking to hail a ride the Big Apples Uber drivers have the potential to make up to 3035 an hour.

Tax and GST Calculator for Uber OLA and TAXIFY Drivers in Australia. The good news is that if you pay tax you can also claim tax deductions and this gets complicated as an accountant will show you what you can claim for example. This includes revenue you make on Uber rides Uber Eats and any other sources of business income.

A l ternating colors. 5-10 minutes What you need to know about tax as a food delivery driver. According to the ATO any Australian resident must declare in your tax return all income you earned anywhere in the world during that tax year.

Order food online or in the Uber Eats app and support local restaurants. Registering for GST. The Rideshare Guy Income and Expenses Spreadsheet allows you to enter your Uber income and vehicle related expenses as they occur.

Then you also pay income tax just like an employee but only on 80 of your profits if you make over 12k. Driver Output Tax Liability b 909. What is an Uber tax calculator.

First-time users Time to Read. Your employer pays the other half. Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue over the past 4 quarters.

The tax year runs from 6th April to 5th April unlike the financial year which runs from 1st January to 31st December. Anyone who is a food delivery driver Tax Difficulty. A The total amount received after the Service Fee is deducted.

You make estimated quarterly payments without needing any documents from Uber. If your annual income is over 37000 then the tax rate is 325 and you can get 675 1-325455625. Start with this and once you lodge your first BAS check whether you had enough saved up or whether you were under or over and adjust your percentage accordingly.

The tax summary provides a. With people becoming busier by the day ordering food has become the norm. Driver Outcome 6591.

For example if your taxable income after deductions is 35000 you will pay 5355 in self-employment taxes.

Does Acceptance Rate Matter On Uber Eats Or Completion Rate

Taxes Doordash Uber Eats Grubhub Instacart Contractors Entrecourier

How To Pay Gst Tax For Uber Drivers In Australia Youtube

37 Below Peak Doordash Stock Could Rise Due To Service Excellence New Markets

How To Pay Gst Tax For Uber Drivers In Australia Youtube

Secured Loan Calculator Cheap Sale 50 Off Www Hcb Cat

Pdf Food Taxes And Subsidies Evidence And Policies For Obesity Prevention

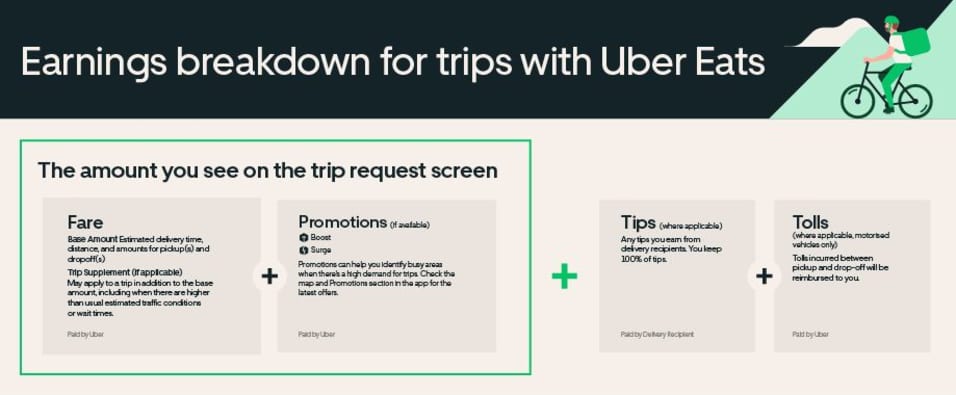

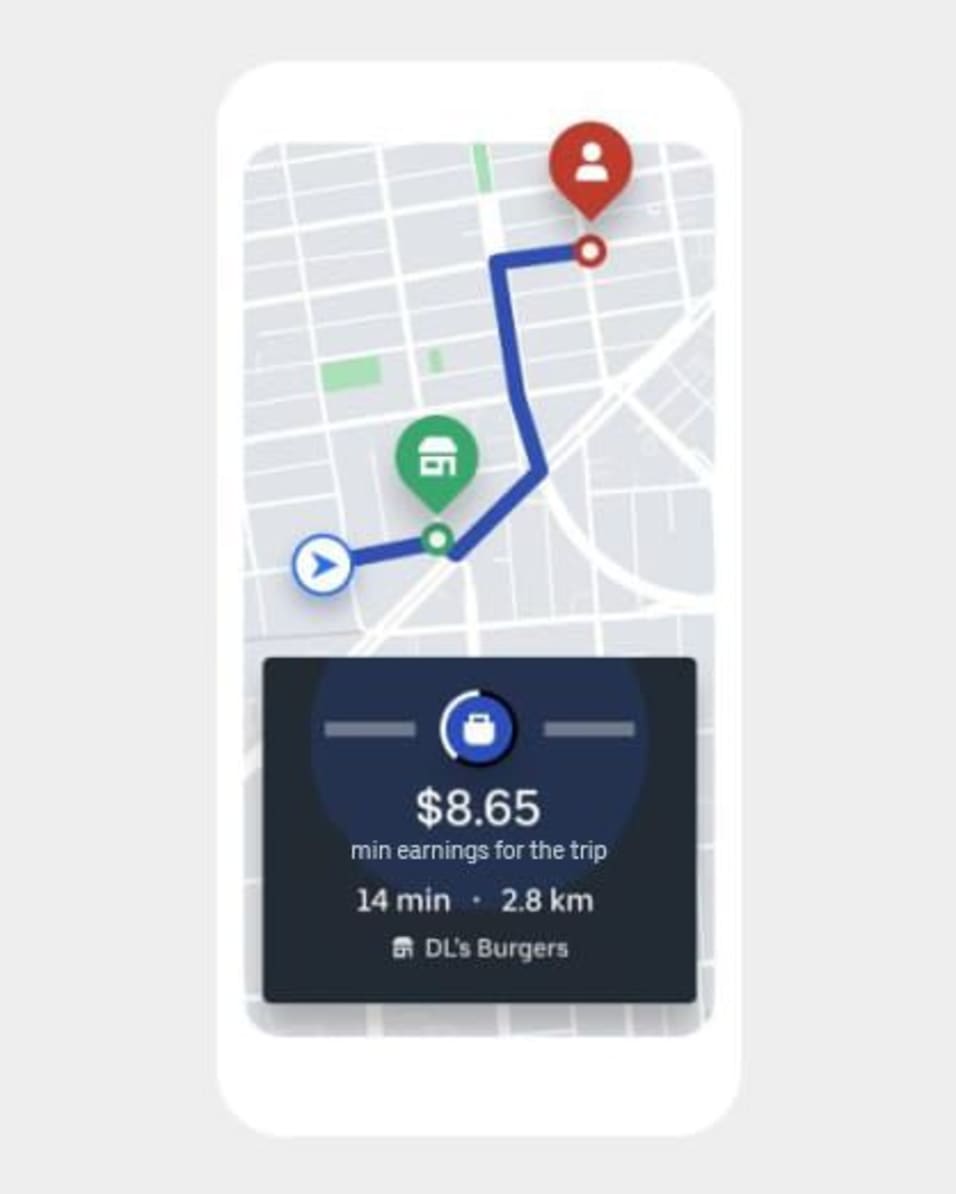

Uber Eats Delivery Partner Earnings In New Zealand Uber

9 Concepts You Must Know To Understand Uber Eats Taxes Via Entrecourier Com In 2022 Understanding Uber Income Tax Return

Ios 14 Icons Minimal White Apple Iphone Ios 14 App Icons Etsy Australia App Icon Iphone Wallpaper App App

Uber Eats Delivery Partner Earnings In New Zealand Uber

Tax Deductions For Uber Didi Ola Shebah Drivers

Does Acceptance Rate Matter On Uber Eats Or Completion Rate

How To Pay Gst Tax For Uber Drivers In Australia Youtube

Uber Eats Delivery Partner Earnings In New Zealand Uber

Bookkeeping Tips For Uber And Other Ridesharing Drivers Accurate Bookkeeping